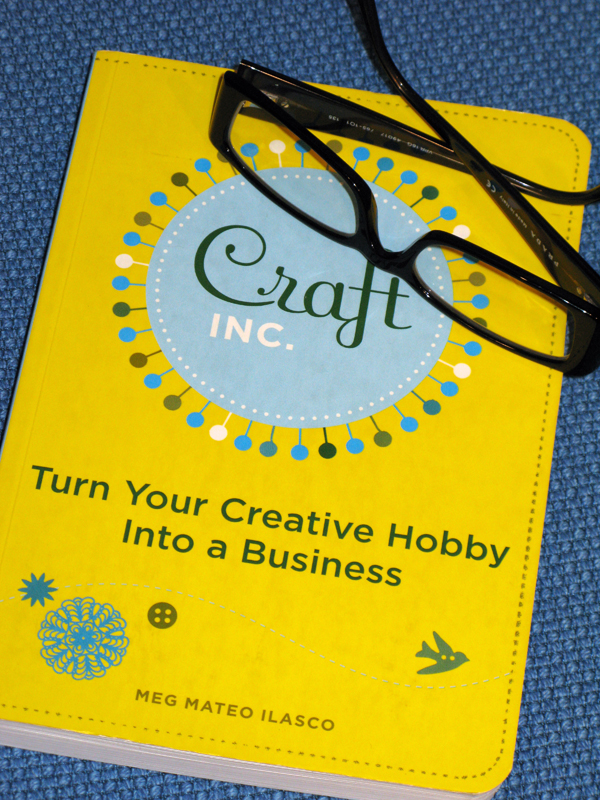

When starting a business it is important to know what the legal requirements are before you start to sell your merchandise. I found a great book called Craft Inc. by Meg Mateo Ilasco which is a wonderful resource that explains the basics of starting your own company. It is important to know that every state has different regulations so it is important to know that the steps I am taking are the required by the state of California.

One of the first things that I had to do was apply for a business license or Business Tax Certificate in the city of San Diego. Since my husband is a freelance web designer and videographer, he had to do this as well. As a married couple we were able to apply for the license together even though he runs his freelance design service under Syntax Graphics and I run my paper goods products under REDSTAR ink. Both ficticious names or Doing Business As (DBA)s are listed on our business tax certificate. To apply, Walker went to the County Treasurer Office, filled out the paperwork and paid the fees. The tax fee was $34 and a processing fee of $25. It is the business owner's responsibility to renew each year.

It is important to do this step first because you will need a DBA in order to apply for a business checking account and a seller's permit.